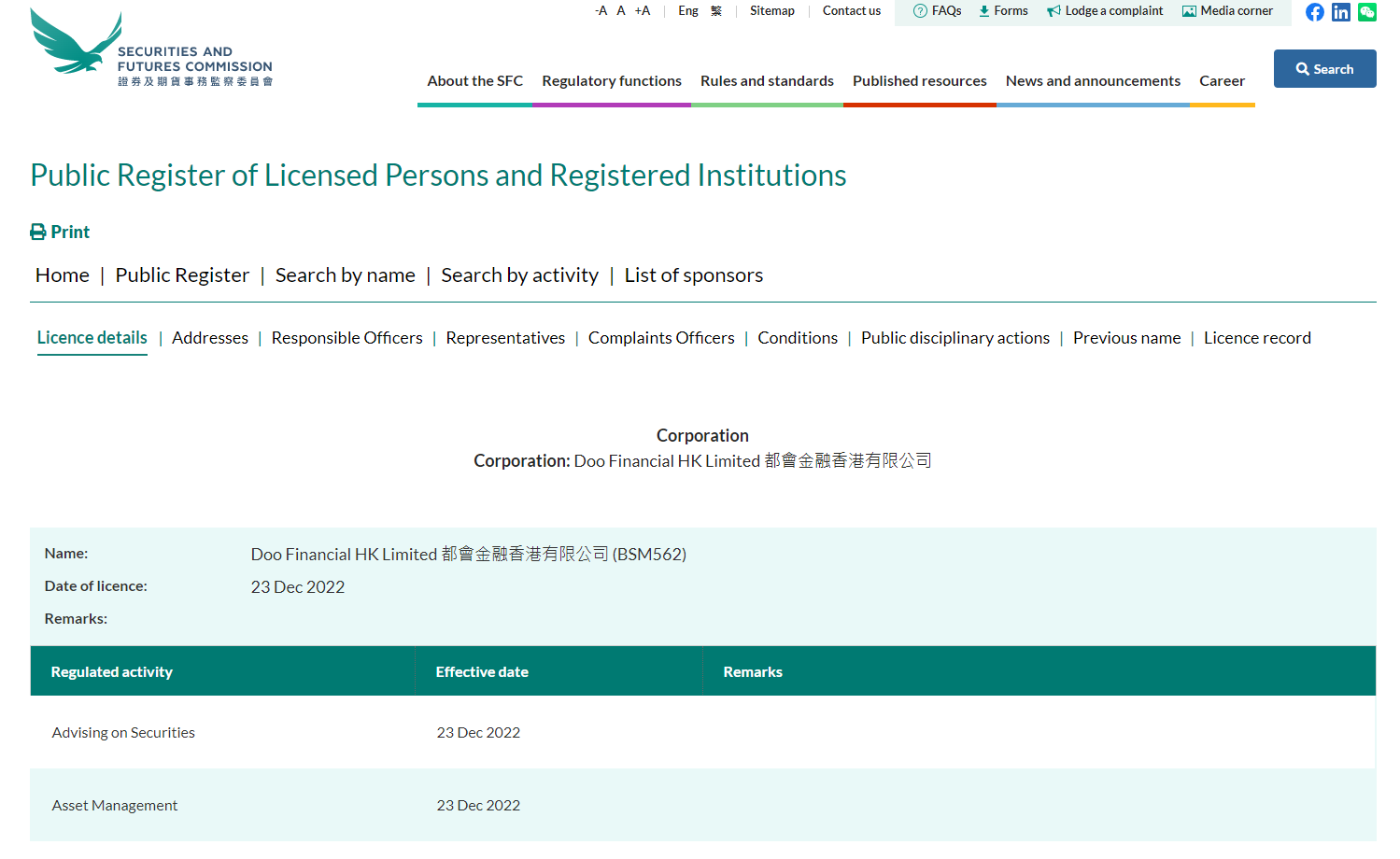

Doo Group’s subsidiary company, Doo Financial HK Limited (Central entity no.: BSM562), marks another milestone in its journey with the obtainment of Type 4 (Advising on Securities) and Type 9 (Asset Management) licenses (Central entity no.: BSM562) issued by the Hong Kong Securities and Futures Commission (HK SFC).

Just celebrating its 8th anniversary in November 2022, Doo Group has been cultivating strong and professional teams across the world throughout its journey. With over 550 industry professionals working professionally for its clients, Doo Group has established over 10 offices that provide services to clients across more than 40 countries and regions. The obtainment of the licenses further demonstrates the rapid growth of Doo Group in diversified global financial markets, especially during times of uncertainty.

Providing Professional Services With The Supervision Of Prominent Financial Regulator

The HK SFC is one of the Hong Kong financial regulators. While the objectives, functions, powers and duties of the SFC are set out in the SFO, the SFC has adopted the following as a statement of its mission: “To strengthen and protect the integrity and soundness of the Hong Kong securities and futures markets for the benefit of investors and the industry”.

Upon obtaining the Type 4 (Advising on Securities) and Type 9 (Asset Management) licenses issued by the HK SFC, Doo Financial HK Limited is allowed to provide clients with the following services:

1) Type 4 (Advising on Securities)

a. giving advice on –

-whether;

-which;

-the time at which; or

-the terms or conditions on which, securities should be acquired or disposed of; or

b. issuing analyses or reports, for the purposes of facilitating the recipients of the analyses or reports to make decisions on –

-whether;

-which;

-the time at which; or

-the terms or conditions on which, securities are to be acquired or disposed of,

For further information, please refer to Cap. 571 Securities and Futures Ordinance – Schedule 5 Regulated Activities: https://www.elegislation.gov.hk/hk/cap571!zh-Hant-HK

2) Type 9 (Asset Management)

a. real estate investment scheme management; or

b. securities or futures contracts management

You may perform a search on 的 HK SFC official website: https://apps.sfc.hk/publicregWeb/corp/BSM562/details

A Significant Milestone In Doo Group’s Global Journey In Achieving Financial Diversity

Over the past eight years, Doo Group has been unleashing the spirit of never stop exploring, turning challenges into opportunities. The obtainment of the Type 4 and Type 9 licenses is a great stride of Doo Group in building a global cohesive financial ecosystem.

As an industry leading financial services group, the group has been discovering more opportunities in various fields of finance to empower clients with a wide range of services. Doo Group always pursues high standards industry practices, ensuring the rights of clients are strictly protected by professional third-party institutions. In the future, Doo Group will continue to venture further towards a better and prosperous future.

关于 Doo Group

Doo Group 都会控股集团(以下简称 “Doo Group”)在 2014 年成立,现总部位于新加坡。经过多年的发展,Doo Group 已经成为一家以金融科技为核心的金融服务集团,拥有 Doo Clearing、Doo Wealth、Doo Financial、Doo Prime、Doo Academy、FinPoints 等多个子品牌,致力为全球各地的个人及机构客户提供超过 2 万个证券、期货、货币对、差价合约和基金等金融产品的交易经纪和资产管理服务。

Currently, the entities within Doo Group, according to their location and products, are regulated by many of the top global financial regulators, including, but not limited to, the United States Securities and Exchange Commission (US SEC) and Financial Industry Regulatory Authority (US FINRA), United Kingdom Financial Conduct Authority (UK FCA), the Australian Securities & Investments Commission (AU ASIC), the Hong Kong Securities and Futures Commission (HK SFC), the Hong Kong Insurance Authority (HK Insurance Broker), the Hong Kong Companies Registry (HK Trust Company), the Hong Kong Customs and Excise Department (HK Money Service Operator), the Malaysia Labuan Financial Services Authority (MY Labuan FSA), the Seychelles Financial Services Authority (SC FSA), Mauritius Financial Services Commission (MU FSC), and the Vanuatu Financial Services Commission (VU FSC). Doo Group has entities operating in various global locations, including Dallas, London, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur as well as other regions.

欲了解更多信息,可通过以下方式联系我们:

香港办公室:+852 6701 2091

新加坡办公室:+65 6011 1736

前瞻性声明

前瞻性声明

本文包含“前瞻性陈述”,并且可以通过使用前瞻性术语来识别,例如 “预期”、“相信”、“继续”、“可能”、“估计”、“期望”、“希望”、“打算”、“计划”、“潜在”、“预测”、“应该” 或 “将会” 或其他类似形式或类似术语,但是缺少此类术语确实并不意味着声明不是前瞻性的。特别是关于 Doo Group 的期望、信念、计划、目标、假设、未来事件或未来表现的声明通常被视为前瞻性声明。

Doo Group 根据 Doo Group 可用的所有当前信息以及 Doo Group 当前的期望、假设、估计和预测提供了这些前瞻性声明。尽管 Doo Group 认为这些期望、假设、估计和预测是合理的,但这些前瞻性陈述仅是预测,并且涉及已知和未知的风险与不确定性,其中许多是 Doo Group 无法控制的。此类风险和不确定性可能导致结果,绩效或成就与前瞻性陈述所表达或暗示的结果大不相同。

Doo Group 不对此类陈述的可靠性,准确性或完整性提供任何陈述或保证,Doo Group 没有义务提供或发布任何前瞻性陈述的更新或修订。

风险披露

由于不可预测的市场变动、基础金融工具的价值和价格波动,金融工具的交易涉及高风险。可能会在短时间内产生超过投资者初始投资的巨额亏损。金融工具的过往表现并不表示其未来表现。对某些服务的投资应利用保证金或杠杆效应,交易价格相对较小的变动可能会对客户的投资产生不成比例的巨大影响,因此客户在利用时应做好承受巨大损失的准备该等交易设施。

在与 Doo Group 其旗下品牌交易平台进行任何交易之前,客户需确保已阅读并完全理解各自金融工具的交易风险。如果客户不了解任何与交易和投资有关的风险,则应寻求独立的专业建议。请参考 Doo Group 与其旗下品牌的客户协议和风险披露声明了解更多。

免责声明

本信息仅供一般参考,仅供大众参考,不应被视为买卖任何金融工具的任何投资建议、推荐、要约或邀请。本文中显示的信息是在未参考或考虑任何特定接收者的投资目标或财务状况的情况下准备的。凡提及金融工具、指数或一揽子投资产品的过去表现,均不应视为其未来业绩的可靠指标。 Doo Group 与其旗下品牌、子公司、合作伙伴及其各自的员工、管理人员对所显示的信息不做任何陈述和保证,对于由于所提供信息的任何不正确和不完整所导致的任何直接、间接、特殊或后果性的损失或损害,Doo Group 与其旗下品牌、子公司、合作伙伴及其各自的员工、管理人员不承担任何责任。对于因任何与个人或客户投资相关的任何直接或间接交易或投资风险、损益,Doo Group 与其旗下品牌、子公司、合作伙伴及其各自的员工、管理人员不承担任何责任,且不负责任何个人或客户遭受与之相关的任何直接、间接、特殊或后果性损失或损害。

Doo Group 2025 年 4 月份交易量报告

Doo Group 2025 年 4 月份交易量报告