Doo Group affiliate, Doo Prime, successfully launches MetaTrader 5 (MT5) on 22. August 2022. This is a new version of trading software that aims to meet the needs of traders for more sophisticated and professional trading.

As a professional trading platform with access to global financial markets, MT5 efficiently links and spans over-the-counter liquidity with over-the-counter futures and stock exchanges.

This allows traders to easily manage multiple asset classes and derivatives at the same time, from equities to futures, from currency pairs to bonds. Thus, making MT5 the best choice for cutting-edge traders.

What Is MetaTrader 5 Trading Platform?

MetaTrader 5 (MT5) is a diversified financial trading platform from

MetaQuotes that supports currency pairs, stocks, futures and bonds. Utilizing the MQL5, which is a specialized programming language, MT5 also provides excellent trading performance and a lower latency trading environment for algorithmic trading, quantitative trading and EA trading.

Compared to MetaTrader 4 (MT4), MT5 offers various unique features that make the trading experience more efficient and convenient for traders. This is why more competent traders are launching MT5 – to provide better services to their clients.

In fact, according to MetaQuotes in June 2021, the number of institutions that are using MT5 has surpassed MT4, making MT5 the current most popular trading platform.

After months of optimization and testing, Doo Prime successfully launches the MT5 platform to provide our clients with a better trading experience.

What Are The Features And Benefits of The Doo Prime MT5 Platform?

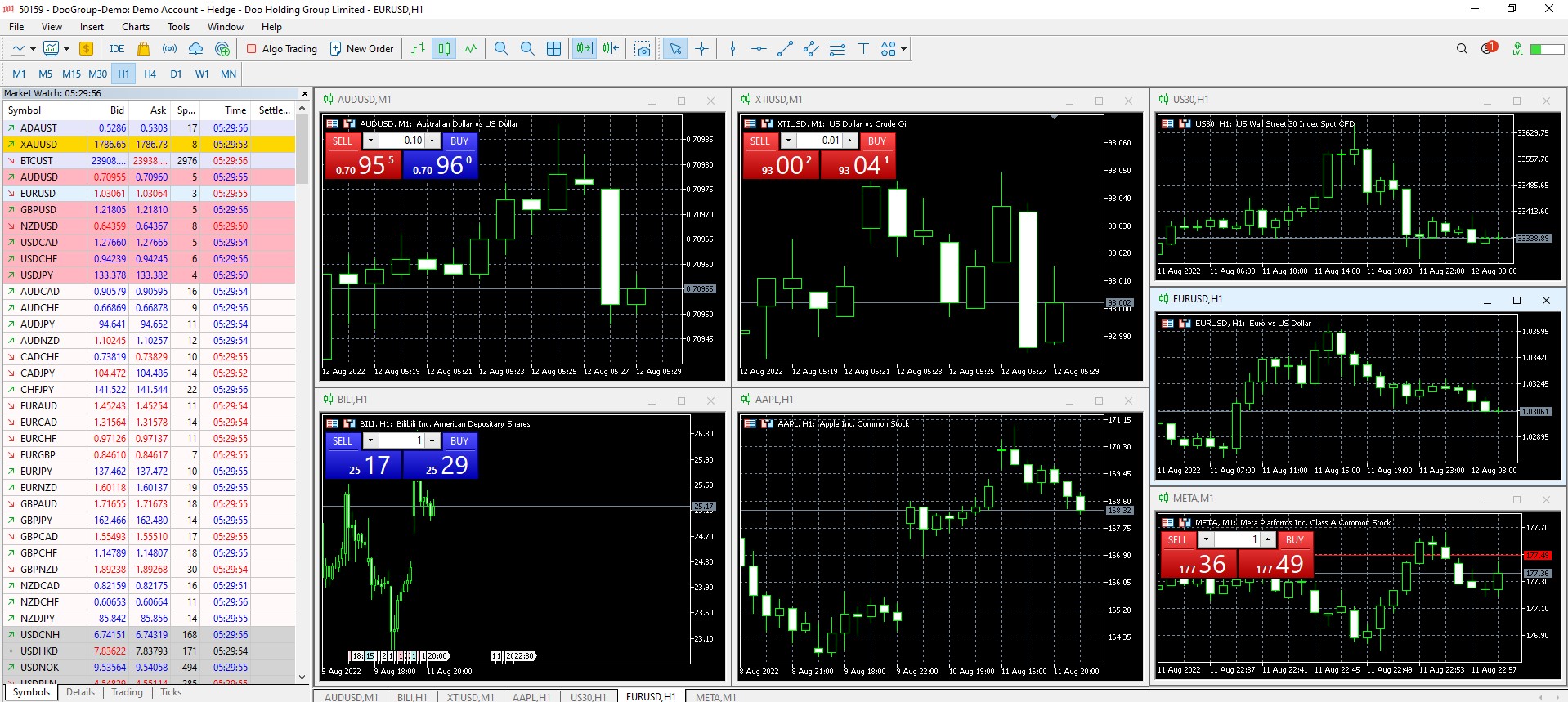

MT5 is a powerful, all-in-one financial trading software that allows traders to invest in multiple markets around the world and trade a wide range of instruments with one click.

With the Doo Prime MT5, you can perform these following functions:

1. Wide Range Of Trading Products

Currently, MT4 only supports access up to 1,024 trading products. As a multi-faceted financial trading platform, MT5 supports trading in tens of thousands of products across different markets – such as currency pairs, stocks and futures – allowing you to build a comprehensive portfolio of investments.

Therefore, with just one MT5 trading account, you can participate in the growth and dividend payments of the most successful listed companies in the world and reduce your capital risk with other financial derivatives, as well as protect your investments, such as futures like USD indices, etc.

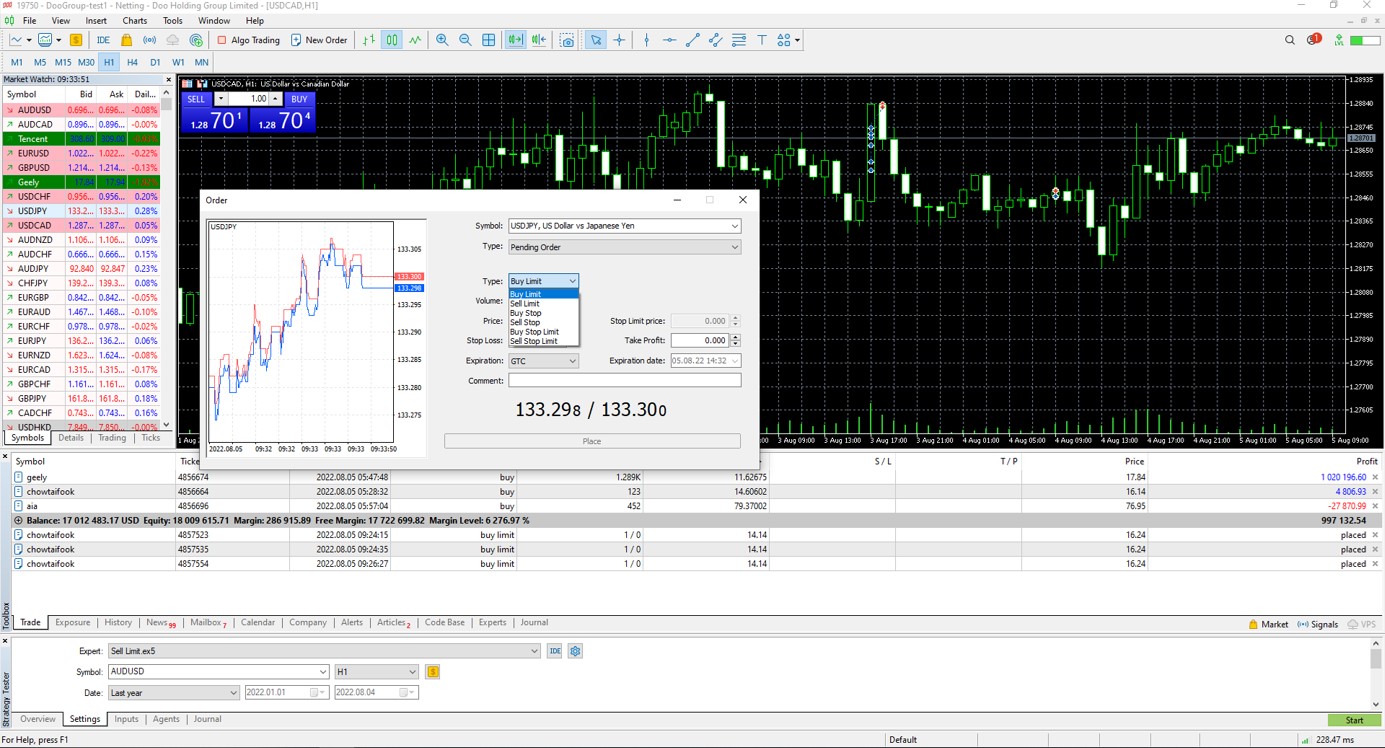

2. Flexible And Comprehensive Trading System

With one account that supports all order types and executions, you can easily manage every trading possibility and lower the chances of missing a buying or selling opportunity. Order types include market orders, pending orders, stop orders and trailing stops.

These 4 order execution formats can be used to achieve a variety of trading objectives: Instant, Request, Market and Exchange execution.

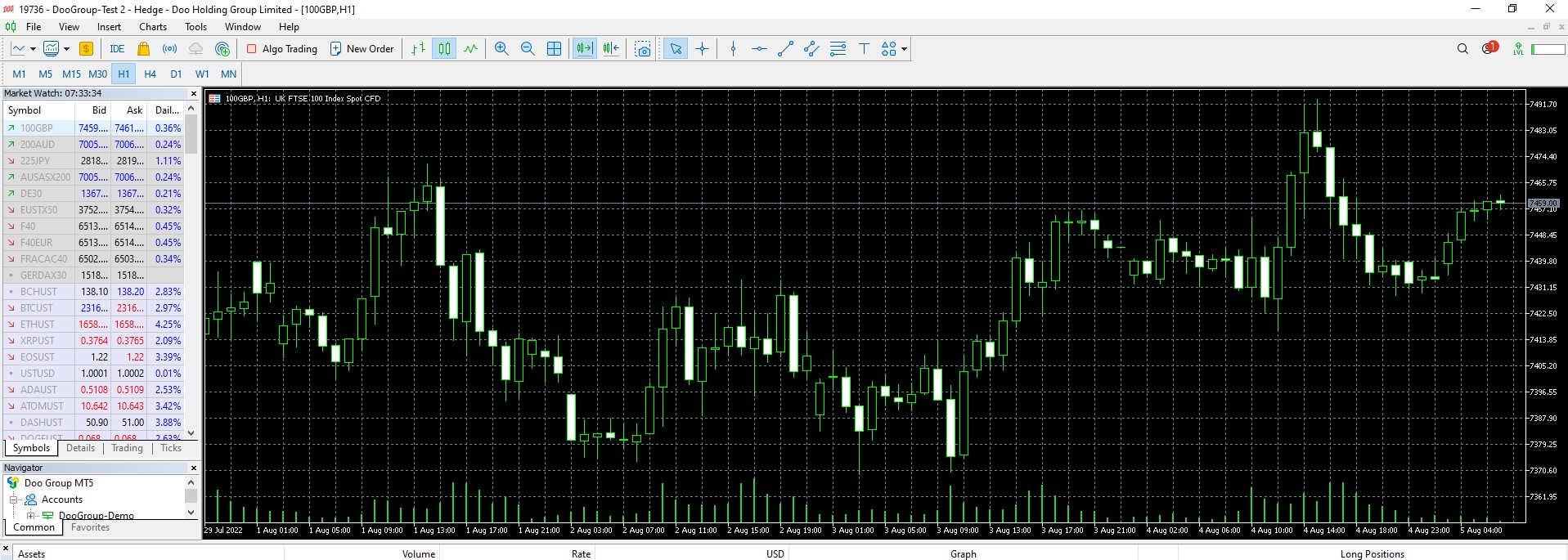

3. Professional Charting And Quote Analysis

The MT5 platform offers more than 80 technical indicators and analysis tools in 21 time-period selection. 100 charts can be opened at once to help you identify the trend of various trading products and create custom indicators.

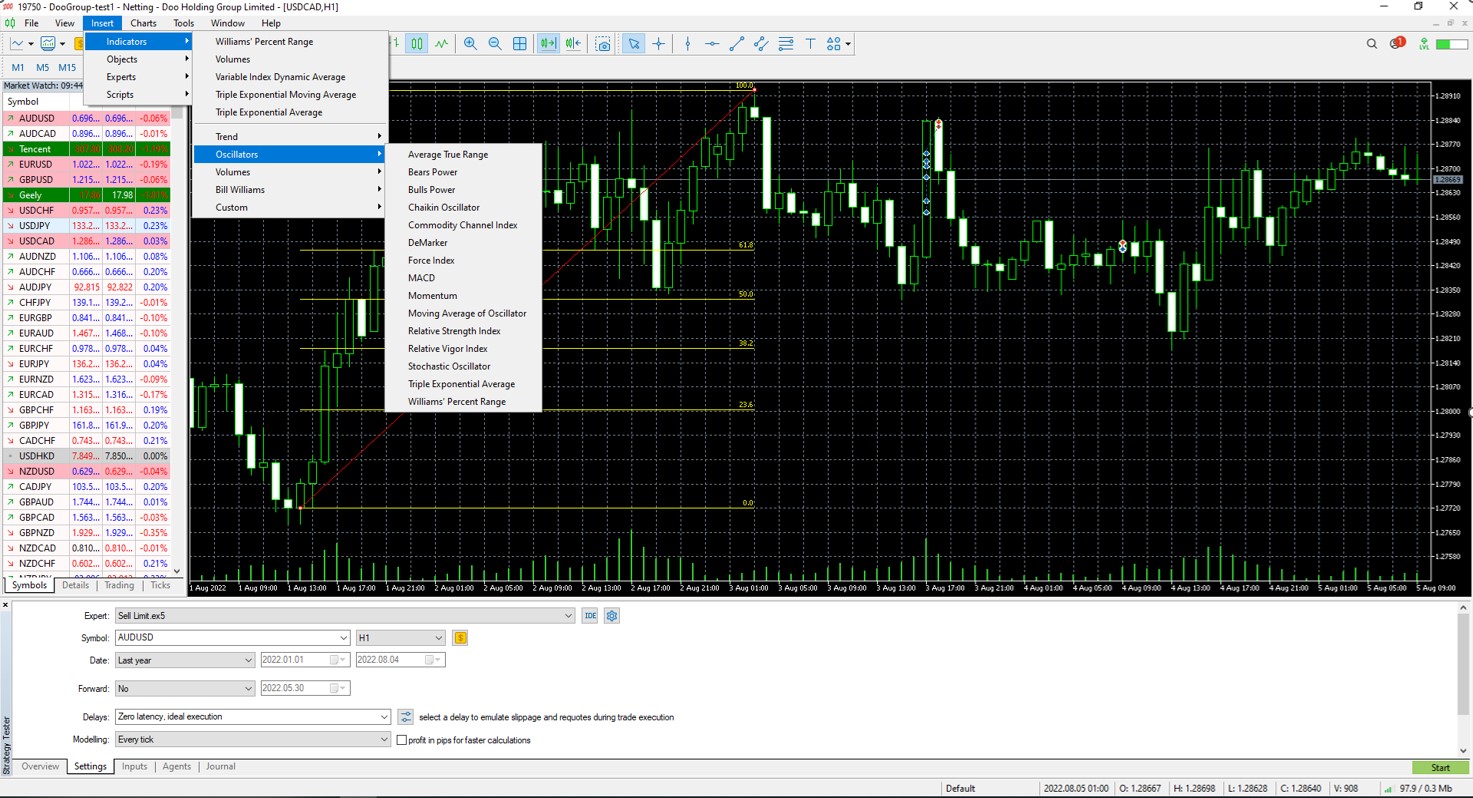

4. Technical Analysis With A Peek Into The Future

The MT5 platform contains 38 technical indicators and 44 graphical objects, providing technical analysts and traders with a more comprehensive and effective trading tool and forecast early insight into the market.

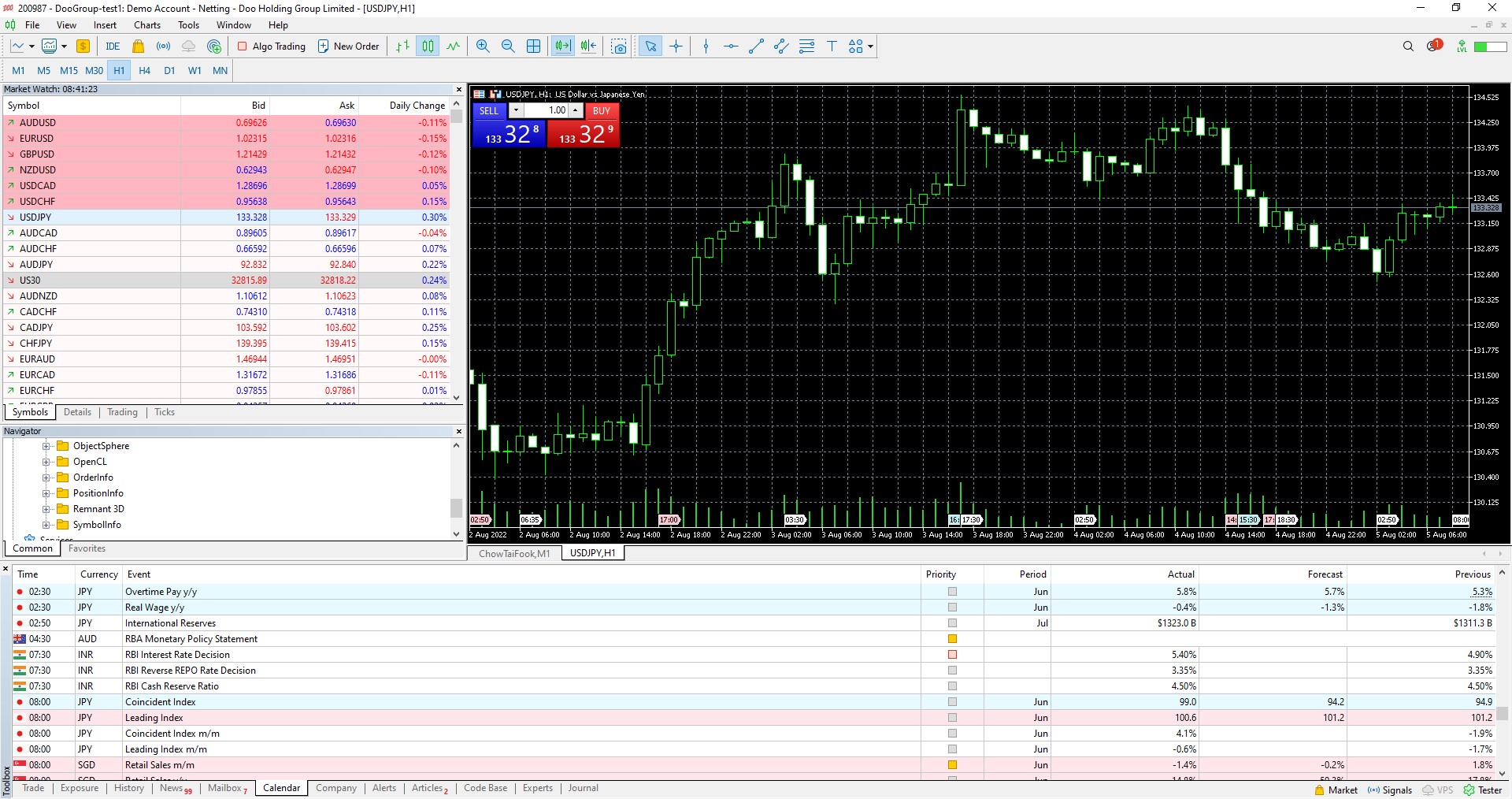

5. Fundamental News In A Holistic Manner

MT5’s built-in tools, like Financial News and Economic Calendar, provide the latest financial news and real-time quotes from international news organizations, keeping you at the forefront of information and making trading operations more up-to-date.

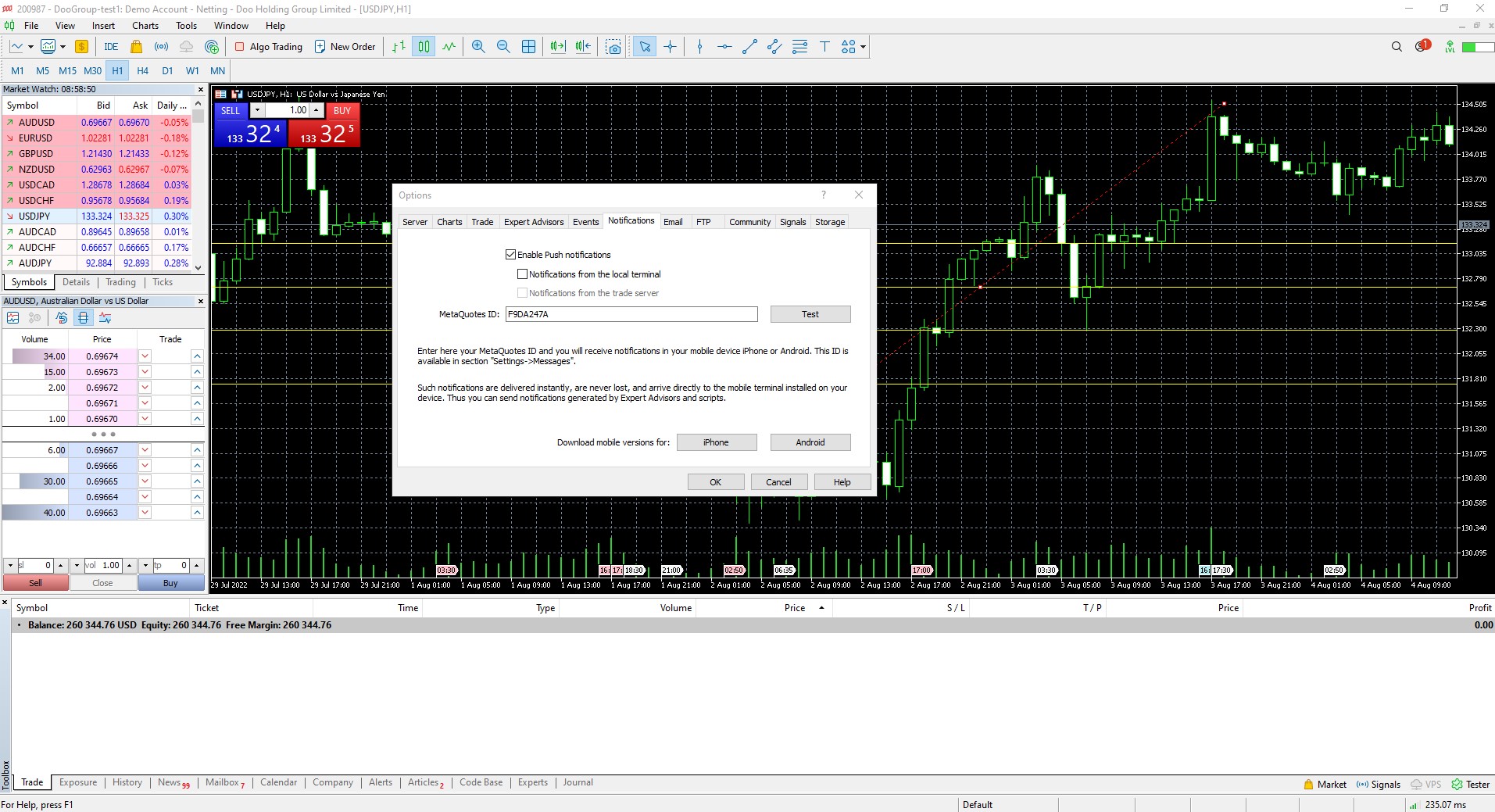

6. Customizable Trading Alert

Simply set the conditions for trade alerts and receive notifications on important trading events via email, mobile phone reminders and more, so you don’t miss out on key trades while you are away from fluctuations and contemplating your investments.

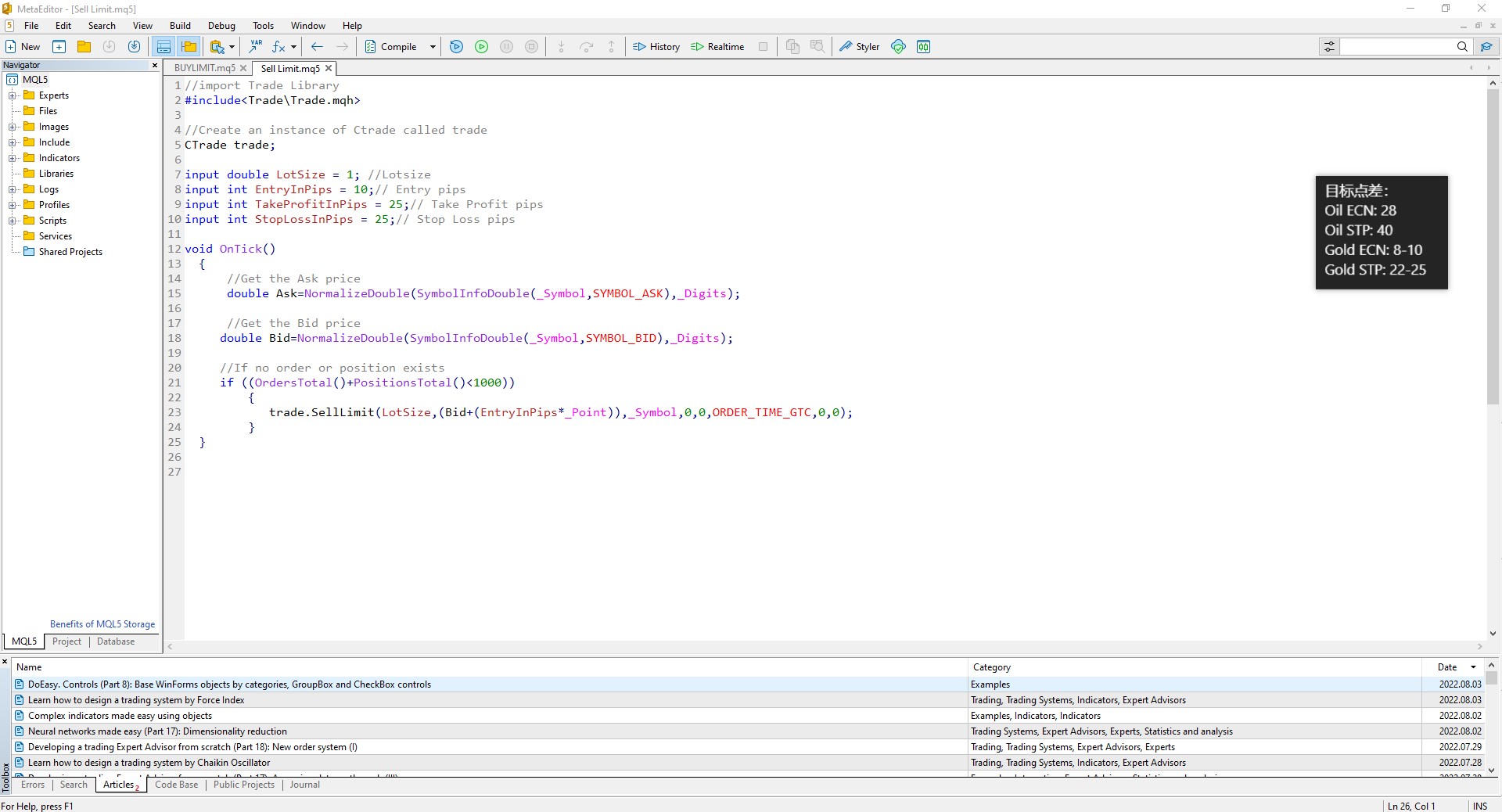

7. Algorithmic Trading Support

MT5 supports Algorithmic Trading, a feature that enables automated trading by analyzing quotes and executing trading operations based on algorithms set by the trader. The MT5 system also provides a complete development environment that allows traders to create and optimise their own EA trading strategies and obtain the most accurate technical analysis and forecasts through the efficient MQL5 programming language.

Doo Prime MT5, One Click Away From Global Investment

Doo Prime has always put the interests of its customers first and is committed to providing safe, reliable and convenient global financial product investment services to make investments in global financial products easy.

As the market continues to evolve, the MT5 platform is set to become the leading trading platform in the financial market. We are confident that the launch of Doo Prime’s MT5 platform will bring a new trading experience to our clients.

In addition, Doo Prime also offers a wide range of reliable trading software including MT4, InTrade, TradingView and FIX API 4.4, allowing clients to start professional and convenient global investment any time, and at their needs.

At Doo Prime, we have made financial technology one of our core strengths and look forward to working with the most advanced trading technology in the market, thereby giving our clients better access to global opportunities.

Moving forward, we will continue to focus on financial technology innovation to become a leading global financial broker with financial technology at its core, and steadfastly serve global investors.

关于 Doo Group

Doo Group 都会控股集团(以下简称 “Doo Group”)在 2014 年成立,现总部位于新加坡。经过多年的发展,Doo Group 已经成为一家以金融科技为核心的金融服务集团,拥有 Doo Clearing、Doo Wealth、Doo Financial、Doo Prime、Doo Academy、FinPoints 等多个子品牌,致力为全球各地的个人及机构客户提供超过 2 万个证券、期货、货币对、差价合约和基金等金融产品的交易经纪和资产管理服务。

截至目前,Doo Group 旗下的法律主体已受全球多家顶尖金融监管机构的严格监管,包括美国证券交易委员会(US SEC)和金融业监管局(US FINRA)、美国金融犯罪执法局(US FinCEN)、英国金融行为监管局(UK FCA)、加拿大金融交易和报告分析中心(CA FINTRAC)、澳大利亚证券与投资委员会(ASIC)、澳大利亚交易报告和分析中心(AUSTRAC)、新加坡金融管理局(SG MAS)、香港证券及期货事务监察委员会(第 1 、4、9 类牌照)、香港保险业监管局(香港保险经纪牌照)、香港公司注册处(香港注册信托公司)、香港公司注册处(信托或公司服务提供者牌照)、香港海关(香港金钱服务经营者牌照)、香港地产代理监管局(HK EAA)、迪拜房地产监管局(AE RERA)、迪拜经济和旅游部(AE PSP)、塞舌尔金融服务管理局(SC FSA)、马来西亚纳闽金融服务管理局(MY Labuan FSA)、毛里求斯金融服务委员会(MU FSC)、瓦努阿图金融服务委员会(VU FSC),并且在达拉斯、伦敦、新加坡、香港、悉尼、塞浦路斯、迪拜、吉隆坡、泰国、南非、埃及、塞舌尔、毛里求斯、瓦努阿图等地设有运营中心。

欲了解更多信息,可通过以下方式联系我们:

Visit us at www.doogroup.com

香港办公室:+852 6701 2091

新加坡办公室:+65 6011 1736

邮箱: [email protected]

Forward-Looking Statement

前瞻性声明

本文包含“前瞻性陈述”,并且可以通过使用前瞻性术语来识别,例如 “预期”、“相信”、“继续”、“可能”、“估计”、“期望”、“希望”、“打算”、“计划”、“潜在”、“预测”、“应该” 或 “将会” 或其他类似形式或类似术语,但是缺少此类术语确实并不意味着声明不是前瞻性的。特别是关于 Doo Group 的期望、信念、计划、目标、假设、未来事件或未来表现的声明通常被视为前瞻性声明。

Doo Group 根据 Doo Group 可用的所有当前信息以及 Doo Group 当前的期望、假设、估计和预测提供了这些前瞻性声明。尽管 Doo Group 认为这些期望、假设、估计和预测是合理的,但这些前瞻性陈述仅是预测,并且涉及已知和未知的风险与不确定性,其中许多是 Doo Group 无法控制的。此类风险和不确定性可能导致结果,绩效或成就与前瞻性陈述所表达或暗示的结果大不相同。

Doo Group 不对此类陈述的可靠性,准确性或完整性提供任何陈述或保证,Doo Group 没有义务提供或发布任何前瞻性陈述的更新或修订。

风险披露

由于不可预测的市场变动、基础金融工具的价值和价格波动,金融工具的交易涉及高风险。可能会在短时间内产生超过投资者初始投资的巨额亏损。金融工具的过往表现并不表示其未来表现。对某些服务的投资应利用保证金或杠杆效应,交易价格相对较小的变动可能会对客户的投资产生不成比例的巨大影响,因此客户在利用时应做好承受巨大损失的准备该等交易设施。

在与 Doo Group 其旗下品牌交易平台进行任何交易之前,客户需确保已阅读并完全理解各自金融工具的交易风险。如果客户不了解任何与交易和投资有关的风险,则应寻求独立的专业建议。请参考 Doo Group 与其旗下品牌的客户协议和风险披露声明了解更多。

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future results. Doo Group makes no representation and warranties to the information displayed and shall not be liable for any direct or indirect loss or damages as a result of any inaccuracies and incompleteness of the information provided. Doo Group shall not be liable for any loss or damages as a result of any direct or indirect trading risks, profit, or loss associated with any individual’s investment.

Doo Group 2025 年 4 月份交易量报告

Doo Group 2025 年 4 月份交易量报告