Doo Group, a large financial services group with financial technology at its core, recently released its March 2022 trading volume report.

March 2022 Trading Volume Overview

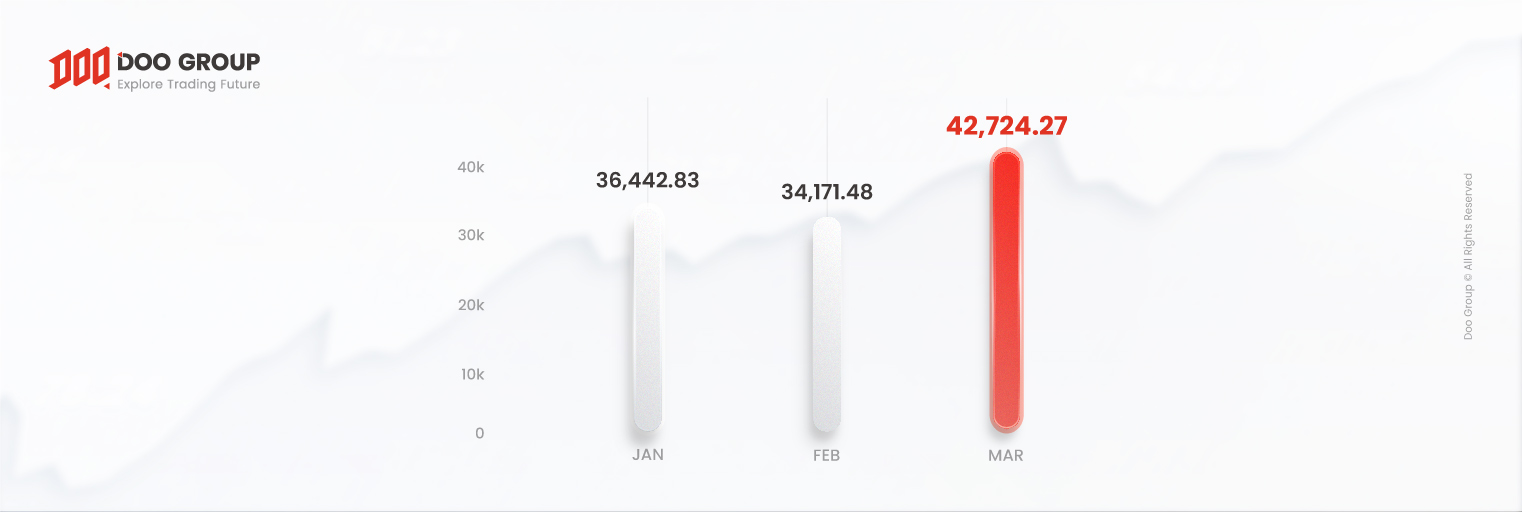

- Total Trading Volume: USD42.72 billion

- Most popular currency pairs of traders: XAU/USD, EUR/USD, GBP/USD

- XAU/USD recorded the highest trading volume at USD25.59 billion

- XAU/USD posted the highest increase of 21.69% (+USD4.57 billion)

Doo Group, a financial services group with cutting-edge technology and solutions, recorded USD42.72 billion in total trading volume on March 2022.

The March 2022 total trading volume sees an increase of 25.03% compared with the previous month. In addition, on a yearly basis, the trading volume significantly increased by 14.65% compared to USD17.33 billion in the same month last year.

Meanwhile, the average daily volume (ADV) in March was USD1.38 billion, an increase of 12.93% compared to the previous month.

This number is a total of trading volumes from the Group’s affiliates, Doo Clearing, which is a London-based FCA-regulated liquidity provider, and Doo Prime, a leading global online broker.

With those figures, Doo Group’s total volume traded for the first quarter of 2022 is valued at USD113.34 billion. Of this total, March has the highest total volume of 37.7%. Doo Group has been reporting solid growth in its trading volume.

According to the latest numbers, XAU/USD, EUR/USD, and GBP/USD were the top choices for traders. They took up 81.22% of total trading volume in March.

In addition, XAU/USD recorded the highest monthly trading volume with USD25.59 billion. The other two strongest pairings are EUR/USD and GBP/USD, which recorded USD9.12 billion of the overall monthly trading volume.

The XAU/USD recorded the highest increase in monthly trading volume, with USD4.57 billion, or 21.69% compared to February.

While there are many factors contributing to this growth, there is no question that Doo Group holds the capability to exemplify this flourishing performance in months and years to come.

The company will continue to create a global fintech system and lead the way to a new era of fintech-driven globalization.

As a financial services group, Doo is committed to establishing a financial ecosystem network that empowers clients to stay one step ahead.

关于 Doo Group

Doo Group 都会控股集团(以下简称 “Doo Group”)在 2014 年成立,现总部位于新加坡。经过多年的发展,Doo Group 已经成为一家以金融科技为核心的金融服务集团,拥有 Doo Clearing、Doo Wealth、Doo Financial、Doo Prime、Doo Academy、FinPoints 等多个子品牌,致力为全球各地的个人及机构客户提供超过 2 万个证券、期货、货币对、差价合约和基金等金融产品的交易经纪和资产管理服务。

Currently, the entities within Doo Group, according to their location and products, are regulated by many of the top global financial regulators, including, but not limited to, the United States Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA), United Kingdom Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the Seychelles Financial Services Authority (FSA), Mauritius Financial Services Commission (FSC), and the Vanuatu Financial Services Commission (SFC). Doo Group has entities operating in various global locations, including Dallas, London, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur as well as other regions.

欲了解更多信息,可通过以下方式联系我们:

官网:www.doogroup.com

香港办公室:+852 6701 2091

新加坡办公室:+65 6011 1736

Email: [email protected]

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future results. Doo Group makes no representation and warranties to the information displayed and shall not be liable for any direct or indirect loss or damages as a result of any inaccuracies and incompleteness of the information.

Doo Group 2023 年 10 月份交易量报告

Doo Group 2023 年 10 月份交易量报告