Doo Group, a large financial services group with financial technology at its core, recently released its August 2022 trading volume report.

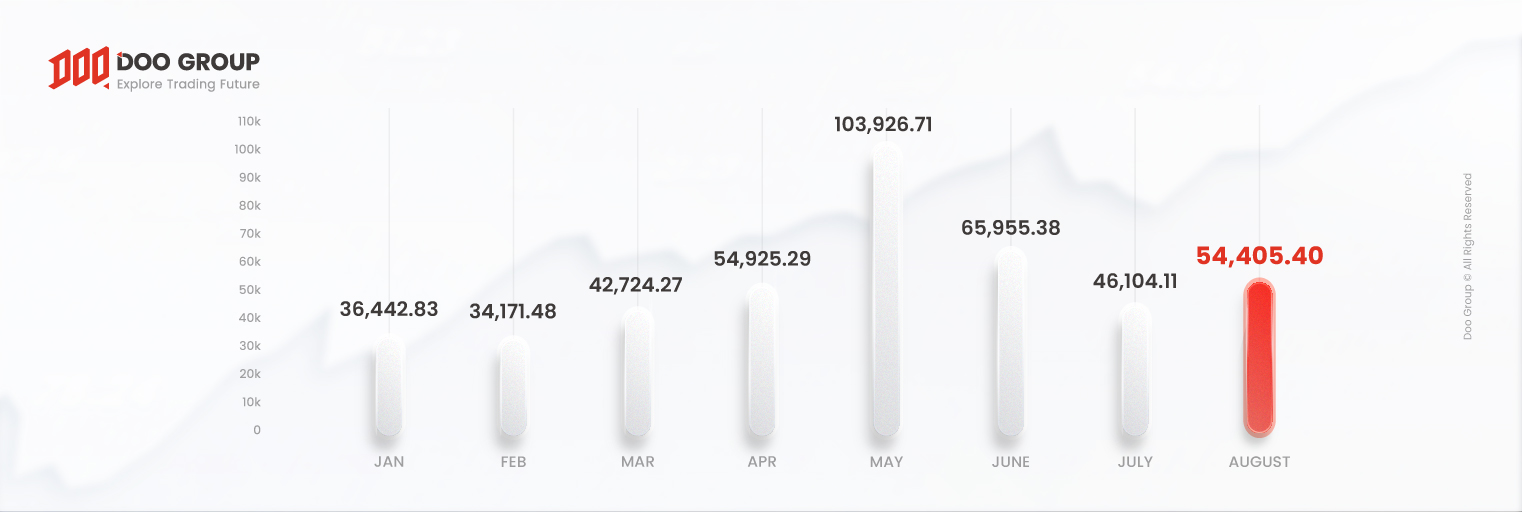

August 2022 Trading Volume Overview

- Total Trading Volume: USD54.41 billion

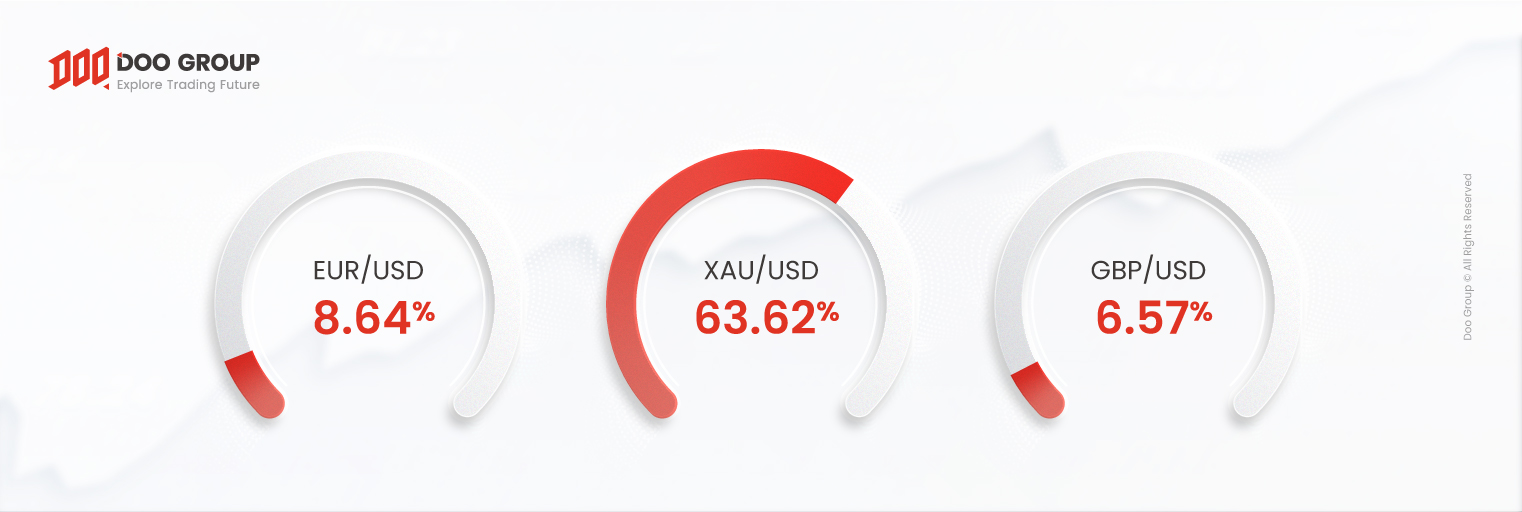

- 热门产品:XAU/USD、EUR/USD、GBP/USD

- XAU/USD recorded the highest trading volume at USD34.61 billion

- XAU/USD posted the highest increase of 14.94% (+USD4.50 billion)

Doo Group, a financial services group with cutting-edge technology and solutions, recorded USD54.41 billion in total trading volume in August 2022.

The August 2022 total trading volume sees an increase of 18.01% compared with the previous month. Nonetheless, on a yearly basis, the trading volume shows a significant increase of 102.9% compared to USD26.82 billion in the same month last year.

Meanwhile, the average daily volume in August was USD1.76 billion, an increase of 18.01% compared to July 2022.

This figure was obtained from the total of trading volumes from the Group’s affiliates, Doo Clearing Limited, which is a London-based FCA-regulated liquidity provider, and Doo Prime, a leading global online broker.

The Group has had a strong year in the trading volumes. The breakthrough growth in the total trading volume in May has set a new record for the first half of the year and increased the overall volume, caused a drop in the trading volume in June and July.

However, the total trading volume growth has improved in August, shows that the Group’s monthly total volume growth remain solid to date.

To date, Doo Group’s total volume traded is valued at USD438.655 billion. Of this total, August saw an increase in the total volume of 129.93% compared to the same period last year.

According to the data, XAU/USD, EUR/USD, and GBP/USD were the top choices for traders. They took up 78.82% of the total trading volume in August.

In addition, XAU/USD recorded the highest monthly trading volume with USD34.61 billion. The other two strongest pairings are EUR/USD and GBP/USD, which recorded USD8.27 billion of the overall monthly trading volume.

The XAU/USD recorded the highest increase in monthly trading volume, with US4.50 billion, or 14.94% compared to July.

While there are many factors contributing to this growth, there is no question that Doo Group holds the capability to exemplify this flourishing performance in months and years to come.

The company will continue to create a global fintech system and lead the way to a new era of fintech-driven globalization.

As a financial services group, Doo is committed to establishing a financial ecosystem network that empowers clients to stay one step ahead.

关于 Doo Group

Doo Group was established in 2014, currently headquartered in Singapore. After years of development, Doo Group has become a multi-faceted financial services group with financial technology at its core. With multiple sub-brands such as Doo Clearing, Doo Financial, Doo Prime, FinPoints and more, Doo Group is committed to provide trading and asset management services for over 20,000 financial products such as Securities, Futures, Forex, CFDs and Funds to global individual and institutional clients.

Currently, the entities within Doo Group, according to their location and products, are regulated by many of the top global financial regulators, including, but not limited to, the United States Securities and Exchange Commission (US SEC) and Financial Industry Regulatory Authority (US FINRA), United Kingdom Financial Conduct Authority (UK FCA), the Australian Securities & Investments Commission (AU ASIC), the Hong Kong Insurance Authority (HK IA), the Hong Kong Customs and Excise Department (HK C&ED), the Hong Kong Companies Registry (HK CR), the Seychelles Financial Services Authority (SC FSA), Mauritius Financial Services Commission (MU FSC), and the Vanuatu Financial Services Commission (VU FSC). Doo Group has entities operating in various global locations, including Dallas, London, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur as well as other regions.

欲了解更多信息,可通过以下方式联系我们:

香港办公室:+852 6701 2091

新加坡办公室:+65 6011 1736

风险披露

由于不可预测的市场变动、基础金融工具的价值和价格波动,金融工具的交易涉及高风险。可能会在短时间内产生超过投资者初始投资的巨额亏损。金融工具的过往表现并不表示其未来表现。对某些服务的投资应利用保证金或杠杆效应,交易价格相对较小的变动可能会对客户的投资产生不成比例的巨大影响,因此客户在利用时应做好承受巨大损失的准备该等交易设施。

在与 Doo Group 其旗下品牌交易平台进行任何交易之前,客户需确保已阅读并完全理解各自金融工具的交易风险。如果客户不了解任何与交易和投资有关的风险,则应寻求独立的专业建议。请参考 Doo Group 与其旗下品牌的客户协议和风险披露声明了解更多。

免责声明

本信息仅供一般参考,仅供大众参考,不应被视为买卖任何金融工具的任何投资建议、推荐、要约或邀请。本文中显示的信息是在未参考或考虑任何特定接收者的投资目标或财务状况的情况下准备的。凡提及金融工具、指数或一揽子投资产品的过去表现,均不应视为其未来业绩的可靠指标。 Doo Group 与其旗下品牌、子公司、合作伙伴及其各自的员工、管理人员对所显示的信息不做任何陈述和保证,对于由于所提供信息的任何不正确和不完整所导致的任何直接、间接、特殊或后果性的损失或损害,Doo Group 与其旗下品牌、子公司、合作伙伴及其各自的员工、管理人员不承担任何责任。对于因任何与个人或客户投资相关的任何直接或间接交易或投资风险、损益,Doo Group 与其旗下品牌、子公司、合作伙伴及其各自的员工、管理人员不承担任何责任,且不负责任何个人或客户遭受与之相关的任何直接、间接、特殊或后果性损失或损害。

Doo Group 2023 年 10 月份交易量报告

Doo Group 2023 年 10 月份交易量报告