Doo Group, a pre-eminent financial services group with FinTech as its core, recently released its June 2024 trading volume report.

June Trading Volume Overview 2024

- Total Trading Volume: USD 105.56 billion

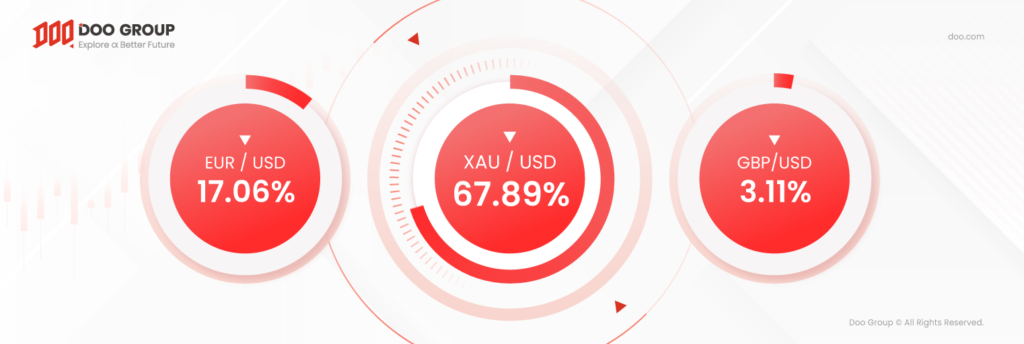

- Most Popular Products: XAU/USD, EUR/USD, GBP/USD

- XAU/USD saw the highest trading volume at USD 71.67 billion.

- EUR/USD saw the highest increase, an increase of USD 7.15 billion, or 65.87%.

According to the report, Doo Group’s total trading volume in June 2024 is valued at USD 105.56 billion, a slight decline of 0.91% from the previous month. Furthermore, June’s average daily volume (ADV) is USD 3.52 billion, a rise of 2.39% from May.

As summer break begins in June, investors’ trading sentiment has slowed down, and this has caused market activity to dampen. Besides, central banks across the world adjusted their interest rates in June. This has led to uncertainties in the market, causing some investors to take a “wait-and-see” approach.

Although there was a slight monthly reduction in Doo Group’s trading volume in June, it still shows a strong year-on-year growth in its trading volume.

Since the beginning of 2024, Doo Group’s trading volume has been in a stable state. Year to date, Doo Group’s total trading volume is valued at USD 570.60 billion, an expansion of 26.13% as compared to the same period last year.

According to the recorded data, XAU/USD, EUR/USD, and GBP/USD were the investors’ top picks, contributing 88.06% of June’s total trading volume. Among them, XAU/USD has the highest monthly trading volume at USD 71.67 billion; while EUR/USD and GBP/USD have a total monthly trading volume of USD 21.29 billion.

Additionally, EUR/USD has the largest growth in the monthly trading volume, an increase of USD 7.15 billion or 65.87% as compared to May.

As an internationally leading financial services group, Doo Group continues to show strong momentum in its trading volume. In the future, Doo Group will continue to develop a global FinTech system and build a comprehensive financial ecosystem. We strive to lead the FinTech transformation in this era, ensuring that our clients are at the forefront of the industry.

Doo Group Reports Record Trading Volume in April 2025

Doo Group Reports Record Trading Volume in April 2025